Through a detailed medical claims audit, BMI Audit Services uncovered key compliance and payment issues totaling over $350,000 in potential exposure for a labor union health fund, reinforcing the importance of accuracy and fiduciary responsibility in healthcare plan administration.

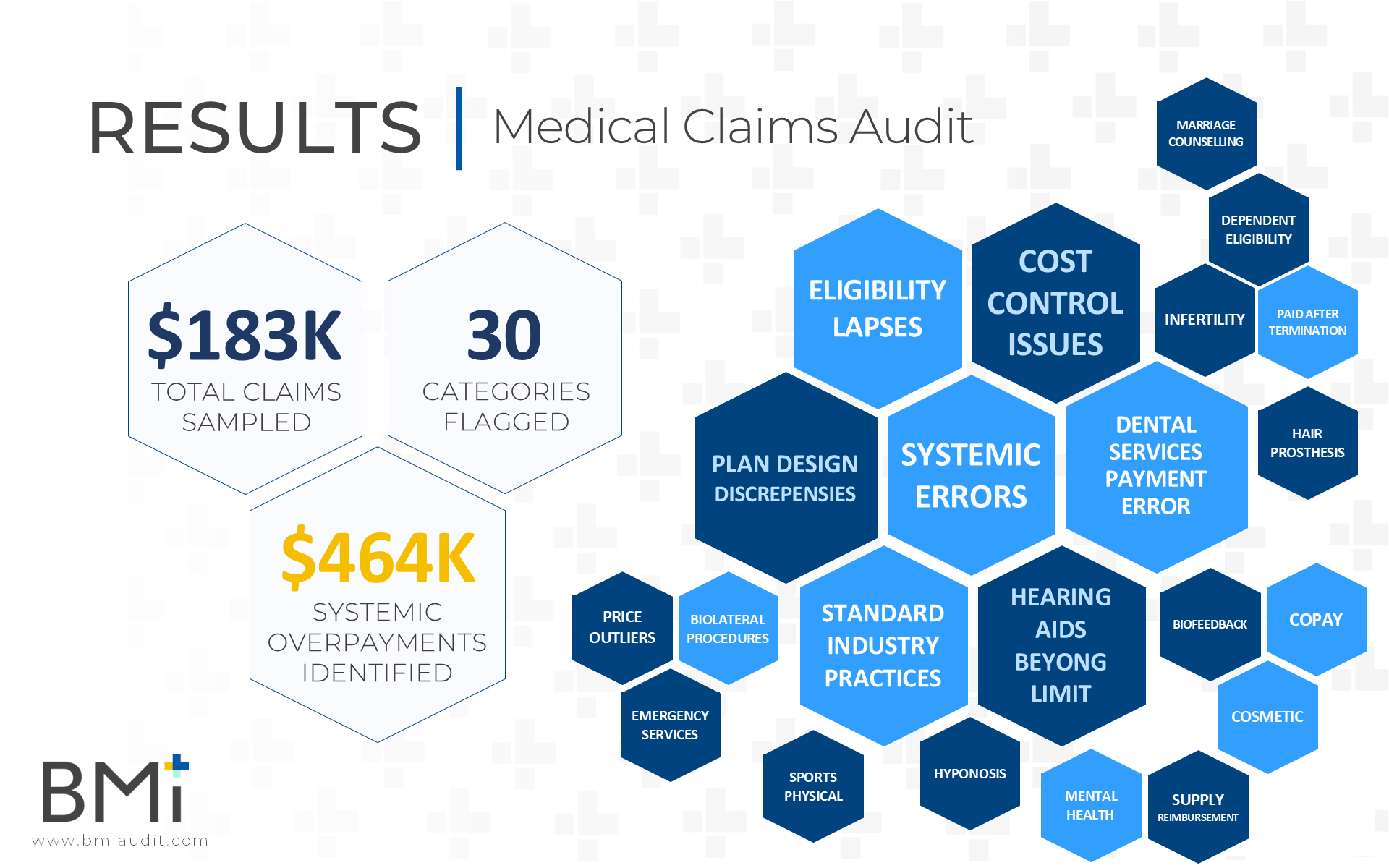

Read MoreBMI’s Medical Claims Audit revealed 30 categories of errors impacting compliance and plan performance. For plan sponsors, regular claims audits ensure SPD alignment, accurate payments, and fiduciary accountability, helping reduce hidden costs and improve compliance across healthcare benefits administration.

Read MoreA major retail employer suspected their medical claims weren’t being processed correctly—and they were right. With the help of BMI Audit Services, they uncovered $28K+ in overpayments due to errors in copayments, coordination of benefits, and plan exclusions.

Read MoreThe Consolidated Appropriations Act of 2021 (CAA) significantly impacts group health plan fiduciaries by eliminating restrictions on data transparency and requiring fiduciaries to monitor their service providers. The Department of Labor (DOL) mandates that plan sponsors ensure plan resources are used correctly, with failure to uphold fiduciary duties leading to severe penalties. This white paper explores the implications of gag clause prohibitions, the importance of claims audits, and how plan sponsors can comply with these regulations to safeguard their fiduciary responsibilities.

Read MoreA food and beverage industry employer, in collaboration with their employee benefits broker, partnered with BMI Audit to conduct a comprehensive medical claims audit after identifying significant errors in claims processing by their third-party administrator (TPA).

Read MoreA Native American Organization with over 9,000 enrolled members engaged BMI to audit and verify the accuracy of medical and prescription drug claims paid their third-party administrator (“TPA”) and pharmacy benefits manager (“PBM”).

Read MoreAn employer in the manufacturing industry with over 450 employees engaged BMI to audit and verify the accuracy of medical and prescription claims payments. Both the medical and pharmacy claims audits identified errors related to claims processing, including payment for ineligible services and systemic administrative issues. The TPA agreed to overpayment amounts totaling over $70,000 and to run additional impact reports to identify any other claims impacted by the systemic issues uncovered. Follow-up audits are recommended for both areas to monitor progress and minimize financial risk.

Read MoreAn employer in the automotive industry with over 10,000 employees engaged BMI to audit and verify the accuracy of medical claims paid by their third-party administrator (“TPA”). The employer had not previously conducted an audit despite being with the TPA for several years.

Read MoreA statewide professional organization in the banking industry contacted BMI after catching several medical claims processing errors by their third-party administrator (“TPA”). Since these mistakes were stumbled upon by accident, a request for a full claims audit was made to ensure all claims were being paid appropriately under the plan.

Read MoreA statewide association of legal professionals contacted BMI to perform an audit of medical claims paid by their third-party administrator (“TPA”) and verify accuracy of claims paid on their behalf.

Read MoreA large insurance pool of educators consisting of over 10,000 employees contacted BMI to perform an audit of claims paid by their third-party administrator (“TPA”). The primary reason for the audit was because the TPA moved to a new platform for claims processing and no prior audits were ever conducted.

Read MoreAudit reveals $77,000+ in overpayments while reviewing just 245 sampled medical claims. A large portion of the findings (just over $66,000) were due to the TPA failing to apply appropriate discounts. As a result of the audit, the TPA has agreed to run impact reports which will identify additional claims with overpayments caused by this same issue.

Read MoreA city government with 7,000 employees engaged BMI to conduct an independent audit of claims paid by their third-party administrator (“TPA”). The primary reason for the audit was to help demonstrate fiduciary responsibility over the plan’s benefits and expenses on behalf of participants

Read MoreA statewide association of financial institutions engaged BMI to conduct an audit of their member’s medical claims paid by their third-party administrator (“TPA”). The association reported higher than expected costs and claimant activity with suspicion of various claims processing issues.

Read MoreAn engineering firm with over 7,000 employees engaged BMI to conduct of medical claims adjudicated by their third-party administrator (“TPA”) after suspecting some COVID-19 claim related expenses were incorrect.

Read MoreAs a result of this medical claims audit, the plan’s TPA agreed to initial overpayment amounts exceeding $56,000 and has initiated refund processes. Manual processor error was given as the cause for many of the identified issues.

Read MoreSince 2011, this city government engages BMI to conduct biennial audits to verify the accuracy of medical claims paid by their third-party administrator (“TPA”).

Read MoreThe TPA agreed to initial overpayment amounts exceeding $5,000, however, further investigation of claims samples by the TPA revealed an additional $150,000 in errant claims outside of those sampled through the audit.

Read MoreA large supermarket chain engaged BMI to verify whether issues uncovered in their last medical claims audit were ultimately fixed by their third-party administrator (“TPA”).

Read More